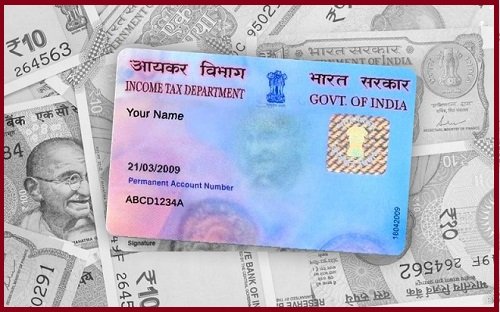

PAN Card 2025

Permanent Account Number (PAN) – A Comprehensive Guide

Introduction to PAN

The Permanent Account Number (PAN) is a unique ten-character alphanumeric code issued by the Income Tax Department of India. It is mandatory for all taxpayers, businesses, and individuals engaging in financial transactions in India. PAN plays a crucial role in tax filing, identity verification, and financial transparency.

Structure of PAN

A PAN follows a specific structure: AAAAA9999A

First three characters – Alphabetic sequence (AAA to ZZZ)

Fourth character – Identifies the type of entity:

P – Individual

C – Company

H – Hindu Undivided Family (HUF)

A – Association of Persons (AOP)

B – Body of Individuals (BOI)

F – Firm

T – Trust

L – Local Authority

J – Artificial Juridical Person

G – Government

Fifth character – First letter of the surname (for individuals) or entity name (for businesses)

Next four characters – Unique numeric identifier

Last character – Alphabetic check digit

Example: ABCDE1234F

Provisions Related to PAN

Issued under Section 139A of the Income Tax Act, 1961.

Mandatory for individuals and businesses filing income tax returns.

Lifetime validity (remains unchanged regardless of relocation).

Must be linked with Aadhaar for verification.

Essential for financial transactions exceeding a specified limit.

Uses of PAN

- Income Tax Filing & Compliance

Required for filing income tax returns (ITR).

Helps in tracking tax payments and financial transactions.

Ensures transparency and prevents tax evasion.

-

Banking & Financial Transactions

Necessary for opening bank accounts (savings, current, fixed deposits).

Mandatory for transactions above ₹50,000.

Required for investments in stocks, mutual funds, bonds, and real estate.

-

Loan & Credit Card Applications

PAN is compulsory for applying for loans (home, car, personal loans, etc.).

Required for credit card approvals and financial background verification.

-

Property Transactions & Business Registration

Mandatory for property purchases/sales exceeding ₹5 lakh.

Essential for business registrations, GST registration, and company formation.

-

Foreign Exchange & Investments

Required for foreign remittances above ₹50,000.

Helps track overseas investments and money transfers.

How to Obtain a PAN

Who Can Apply for PAN?

Indian Citizens (Individuals, salaried employees, students, and self-employed persons)

Hindu Undivided Families (HUFs)

Companies, LLPs, and Partnerships

Trusts, NGOs, and Societies

Foreign Citizens & Foreign Entities operating in India

Steps to Apply for PAN

Online Application

Visit NSDL or UTIITSL official website.

Fill out Form 49A (for Indian citizens) or Form 49AA (for foreign nationals).

Upload identity, address, and date of birth proof.

Pay the application fee online.

Receive PAN via post or email within 15-30 days.

Offline Application

Download and fill Form 49A/49AA from the Income Tax Department website.

Attach required documents and submit them at a PAN center.

Receive PAN card within 15-30 working days.

Accepted Documents for PAN Application

-

Proof of Identity

Aadhaar Card

Passport

Voter ID

Driving License

Ration Card with photograph

Government-issued ID for Government Employees

-

Proof of Address

Aadhaar Card

Passport

Utility Bill (Electricity, Water, Gas, Telephone)

Bank Statement

Voter ID

Rent Agreement

PAN for Foreign Citizens & Entities

Foreigners investing in India or setting up businesses must also obtain a PAN. Required documents include:

Copy of passport (foreign citizens)

Address proof from foreign country or India

Foreign institutional investors must provide registration certificates

PAN Requirements for Businesses

Entities such as firms, LLPs, and companies must apply for a PAN to conduct business in India. Documents required include:

Certificate of Incorporation

Memorandum and Articles of Association

Registration Certificate (for LLPs and firms)

Transactions Requiring PAN Quotation

PAN must be quoted in the following transactions:

Deposits exceeding ₹50,000 in banks

Property purchase/sale over ₹5 lakh

Stock, mutual fund, and bond transactions exceeding ₹50,000

Foreign exchange transactions over ₹50,000

Buying jewelry worth more than ₹5 lakh

Notice of Changes in PAN Details

If a PAN holder changes their name, address, or signature, they must submit a PAN correction request with supporting documents. The correction can be done online or at PAN service centers.

Application for New PAN Under New Series

If a PAN card is lost or damaged, one can apply for a reprint or request a new PAN under a revised series using Form 49A.

PAN vs Payment Card Number

Although similar in structure, PAN and payment card numbers serve different purposes:

PAN is for taxation and identity verification.

Payment Card Numbers (PCN) are used for financial transactions.

PAN does not change, whereas PCN may change if the card is lost or reissued.

Conclusion

The Permanent Account Number (PAN) is an indispensable document for tax compliance, financial transactions, and business operations in India. It ensures financial transparency, helps in tax filings, and prevents fraudulent activities. Whether you are an individual, business entity, or foreign investor, obtaining and using a PAN correctly ensures smooth financial activities. Apply today and secure your financial identity in India!

Permanent Account Number (PAN) – Everything You Need to Know

Introduction

A Permanent Account Number (PAN) is a unique, 10-character alphanumeric identifier issued by the Income Tax Department of India. It is crucial for financial transactions, tax filings, and identity verification. PAN is essential for both individuals and businesses.

Structure of PAN

A PAN follows a standard format: AAAAA9999A

The first five characters are letters (alphabets).

The next four characters are numbers (digits).

The last character is a letter (alphabet).

The fourth letter represents the PAN holder’s category:

P: Individual

H: Hindu Undivided Family (HUF)

C: Company

F: Firm

A: Association of Persons (AOP)

T: Trust

Provisions and Uses of PAN

Mandatory Uses of PAN

Filing Income Tax Returns (ITR)

Opening a bank account

Buying or selling assets above ₹50,000

Depositing cash above ₹50,000 in banks

Applying for a credit card

Purchasing foreign currency

Buying jewelry over ₹2 lakh

Investing in securities above ₹50,000

For businesses with turnover exceeding ₹5 lakh

Property transactions above ₹10 lakh

Other Uses of PAN

Acts as proof of identity

Helps prevent tax evasion

Required for loan applications

Mandatory for GST registration

How to Apply for PAN?

Who should apply?

Indian citizens

Foreign citizens doing business in India

Companies, firms, and organizations

Trusts and non-profit entities

Steps to Apply for PAN

Visit the NSDL or UTIITSL website.

Select the appropriate form:

Form 49A (for Indian citizens)

Form 49AA (for foreign citizens)

Fill in the details like name, date of birth, and address.

Upload required documents.

Pay the processing fee.

Submit the application and track status.

Receive PAN card at the registered address.

Documents Required for PAN

For Individuals and HUF

Proof of Identity:

Aadhaar Card

Passport

Voter ID

Driving License

Ration Card

Proof of Address:

Utility Bills (Electricity, Water, Gas)

Aadhaar Card

Passport

Rental Agreement

For Businesses & Non-Individuals

Certificate of Incorporation (Companies)

Partnership Deed (Firms)

Trust Deed (Trusts)

Registration Certificate (LLPs)

PAN for Foreign Citizens

Foreign citizens or entities conducting financial transactions in India must obtain a PAN. They need to submit:

Conclusion

A Permanent Account Number (PAN) is an essential tool for financial identity in India. Whether you are an individual, a business owner, or a foreign entity dealing in India, having a PAN is mandatory for smooth financial transactions. Understanding the structure, uses, and application process ensures compliance with Indian tax laws and hassle-free banking operations.

Stay informed, stay compliant!